The Complete Guide to Boat Insurance: Navigating Coverage for Your Watercraft

Introduction:

Understanding Boat Insurance

What is Boat Insurance?

- Boat insurance is a specialized type of insurance designed to provide financial protection for watercraft owners against potential risks and liabilities associated with owning and operating a boat.

- It serves to safeguard the owner's investment in the boat and provides coverage for damages, losses, or injuries that may occur while the boat is in use.

How Does Boat Insurance Work?

- Boat insurance operates similarly to other types of insurance policies, where the policyholder pays a premium in exchange for coverage.

- In the event of an accident, theft, or damage to the boat, the policyholder can file a claim with the insurance company to receive compensation for covered losses.

- Coverage may vary depending on the specific terms and conditions outlined in the policy, as well as any deductibles or limits set by the insurer.

Types of Boats Covered

- Boat insurance typically covers a wide range of watercraft, including sailboats, motorboats, yachts, jet skis, and other recreational vessels.

- The specific types of boats covered may vary depending on the insurance provider and the policy selected by the boat owner.

Coverage Options

- Property Damage: Covers the cost of repairing or replacing the boat if it is damaged or destroyed in an accident, collision, or natural disaster.

- Liability: Provides coverage for bodily injury or property damage caused by the insured boat to others, such as other boaters, swimmers, or waterfront property.

- Medical Payments: Reimburses the policyholder and passengers for medical expenses incurred as a result of injuries sustained while on the insured boat.

- Uninsured Boater: Protects the policyholder against damages caused by boaters who do not have insurance or insufficient coverage to pay for damages they cause.

Legal Requirements for Boat Insurance

- The legal requirements for boat insurance vary by state and waterway, with some jurisdictions mandating boat owners to carry a minimum level of liability coverage.

- These requirements may also depend on factors such as the size and type of boat, its intended use, and where it will be operated.

- Boat owners should familiarize themselves with the specific legal requirements for boat insurance in their area to ensure compliance with local regulations and avoid potential penalties or fines.

Coverage Options

Hull Coverage:

Protection for physical damage to your boat in accidents, collisions, or storms.

Liability Coverage:

Coverage for bodily injury or property damage caused by your boat to others.

Medical Payments Coverage:

Reimbursement for medical expenses for injuries sustained by you or your passengers.

Uninsured/Underinsured Boater Coverage:

Protection against damages caused by boaters with insufficient or no insurance.

Personal Property Coverage:

Coverage for personal belongings onboard your boat, such as equipment, electronics, and fishing gear.

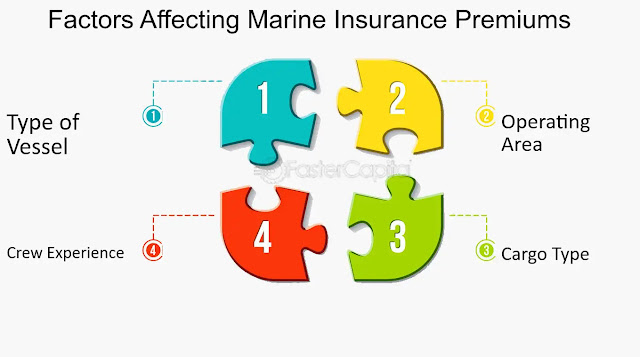

Factors Affecting Boat Insurance Premiums

- Type and value of the boat

- Age, condition, and safety features of the boat

- Usage and navigation areas (e.g., inland waters, coastal waters, offshore)

- Owner's boating experience and safety record

- Storage and mooring location

- Deductible amount chosen

Additional Coverage Options

Emergency Towing and Assistance:

Coverage for towing services in case of breakdown or emergency on the water.

Wreck Removal Coverage:

Coverage for the removal of your boat if it sinks or becomes stranded.

Fuel Spill Liability Coverage:

Coverage for costs associated with cleaning up fuel spills caused by your boat.

Fishing Equipment Coverage:

Coverage for specialized fishing equipment and accessories onboard your boat.

Discounts and Savings Opportunities

- Multi-Policy Discounts: Bundling boat insurance with other policies, such as home or auto insurance.

- Safety Equipment Discounts: Installing safety features such as navigation lights, fire extinguishers, and GPS systems.

- Boating Education Discounts: Completing boating safety courses or certifications.

- Claims-Free Discounts: Maintaining a claims-free record over time.

Tips for Choosing the Right Policy

- Assess your coverage needs based on your boat's value, usage, and navigation habits.

- Compare quotes from multiple insurance providers to find the best coverage at a competitive price.

- Review policy terms, conditions, and exclusions carefully to understand what is covered and what is not.

- Consider the financial stability and reputation of the insurance company before purchasing a policy.

- Consult with an insurance agent or broker for personalized guidance and recommendations.

Filing Claims and Managing Your Policy

- Understanding the claims process and how to file a claim in the event of an accident or loss.

- Keeping detailed records of your boat's maintenance, upgrades, and modifications.

- Reviewing and updating your policy annually to ensure it reflects any changes to your boat or boating habits.

- Communicating with your insurance provider regularly to address any questions or concerns about your coverage.

Conclusion:

Boat insurance is an essential investment for boat owners, providing financial protection and peace of mind while enjoying time on the water. By understanding the different coverage options, factors affecting premiums, and tips for choosing the right policy, you can ensure your watercraft is adequately protected against risks and liabilities. Whether you own a sailboat, powerboat, or jet ski, boat insurance offers the security you need to navigate the open waters with confidence in 2024.

Why Do I Need Boat Insurance?

Topic Keywords

insurance,boat insurance,auto insurance,business insurance,best boat insurance,life insurance,home insurance,best recipe for insurance,boat insurance tips,cheap boat insurance,rv insurance,insurance for your boat,car insurance,progressive boat insurance,homeowners insurance,commercial insurance,best boat insurance of 2024,insurance boat,boat insurance co,2024 insurance trends,low boat insurance,boating insurance,sailboat insurance

.jpeg)

.jpeg)

.jpeg)

Post a Comment